Debts & Loans2 December 2025

Can I list money owed to my parents on Form E? (The 'Soft Loan' Trap)

Borrowed money from the 'Bank of Mum and Dad'? Be careful. If you list it as a debt on Form E without a contract, the court may treat it as a gift. Here is how to distinguish a "Hard Debt" from a "Soft Debt" before you file.

## You're staring at Section 2.9 of Form E, and you're stuck.

Your parents lent you £20,000 for the deposit on your house three years ago. Now you're divorcing. The question feels impossible: *Do I list that £20k as a debt on Form E?*

If you don't list it, it feels like you're losing your parents' money forever—money they might desperately need back. But if you *do* list it, you're worried it'll look dodgy. What if the court thinks you're making it up? What if your ex's solicitor tears it apart?

You're not imagining this problem. It's one of the most common traps people fall into when completing Form E themselves—and it can seriously damage your credibility in court.

Let's talk about what the Family Court actually thinks about money from family.

## Hard Debts vs. Soft Debts: What the Court Recognises

Not all debts are treated equally on Form E. The Family Court divides them into two categories:

**Hard Debts** are the ones the court respects without question:

- Bank loans with formal agreements

- Credit card balances with statements

- Mortgages with redemption figures

- Car finance with contracts

These debts have paperwork. They have interest rates. They have consequences if you don't pay. The court accepts them as genuine liabilities and deducts them from your total assets.

**Soft Debts** are a different story entirely:

- Money from Mum and Dad

- A "loan" from your brother

- Cash from a friend to help with the kids' school fees

- Money from family "to be paid back when you can"

Here's the brutal truth: **without a written loan agreement *and* proof of regular repayments, the Family Court will usually treat money from family as a gift—not a loan.**

This principle is called the **Presumption of Advancement**. The court assumes that parents give money to their children out of love and support, not as a commercial transaction. Unless you can prove otherwise with contemporaneous evidence (a formal contract signed at the time, bank transfers showing monthly repayments, a repayment schedule), the court will likely ignore it as a debt.

Why? Because judges see this attempted every single week: couples suddenly "remembering" massive loans from family members, conveniently reducing the matrimonial pot just before settlement. The court has to protect against manufactured debts designed to hide wealth from the other spouse.

It doesn't matter if the money *was* genuinely intended as a loan. If you can't prove it on paper, it's a gift in the court's eyes.

## What Happens If You List a Soft Loan Anyway?

Let's say you list "£20,000 owed to parents" in Section 2.9 of your Form E.

Here's what you're facing:

**The judge will likely "add it back"** to the matrimonial pot. Instead of reducing your net assets by £20k, the court treats the full house value as available for division. Your parents' money? Still gone—but now you've gained nothing from declaring it.

**You lose credibility.** The court doesn't like people who try to game the system. Once a judge doubts your honesty on one item, they'll scrutinise everything else you've declared. Your entire Form E is now under suspicion.

**Your ex's solicitor will go for the jugular.** Expect aggressive questioning: "Where is the signed loan agreement?" "Why are there no repayments on your bank statements?" "Did your parents charge interest?" "When did you discuss terms?" If you can't answer convincingly, you'll look dishonest—even if you're not.

This isn't about fairness. It's about what you can **prove**. And most family "loans" simply can't meet that burden of proof.

## How Do You Know If Your Loan Is Hard or Soft?

This is where most people get stuck. You *think* it was a loan—but was it really? Did you sign anything? Have you made a single repayment? Was there ever a conversation about interest or a repayment date?

**This is exactly why Divvio exists.**

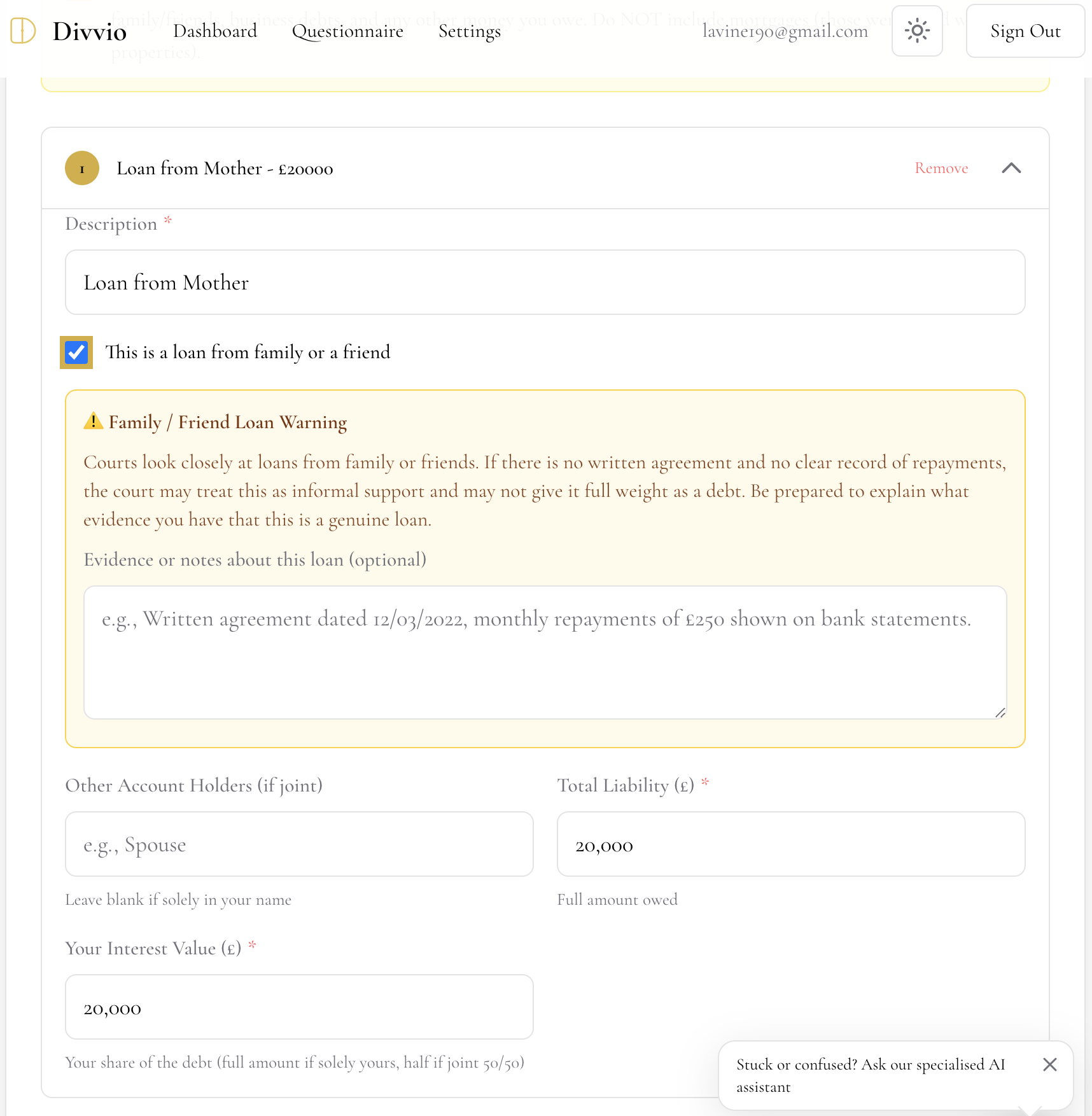

When you reach Step 17 (Liabilities) in the Divvio software, it doesn't just let you type in random debts and hope for the best. Divvio's smart system automatically detects high-risk words like "Mum," "Dad," "parents," "family," or "loan from."

The moment you try to add a soft loan, Divvio pops up a **legal reality check**:

*"⚠️ Family loans without a written agreement are usually treated as gifts by the Family Court. Are you sure you want to include this? Learn more."*

You get a clear explanation, example scenarios, and guidance on what evidence you'd need to make it stick—*before* you submit your Form E to the court or your ex's solicitor.

No nasty surprises. No awkward questions at the First Appointment. No damaged credibility.

**Try Divvio for free today and let the software check your liabilities section before you file.** Think of it as having a family law solicitor reading over your shoulder—except it costs a fraction of the price and works 24/7.

[**Start Filling your form now**](/eligibility)

---

*Divvio is not a law firm and does not provide legal advice. If you have complex financial circumstances or concerns about specific debts, we recommend consulting a qualified family law solicitor.*